Your Path to Smart Investing

Discover the power of ETFs - diverse, low-cost, and flexible investment vehicles that make your money work smarter.

About Us

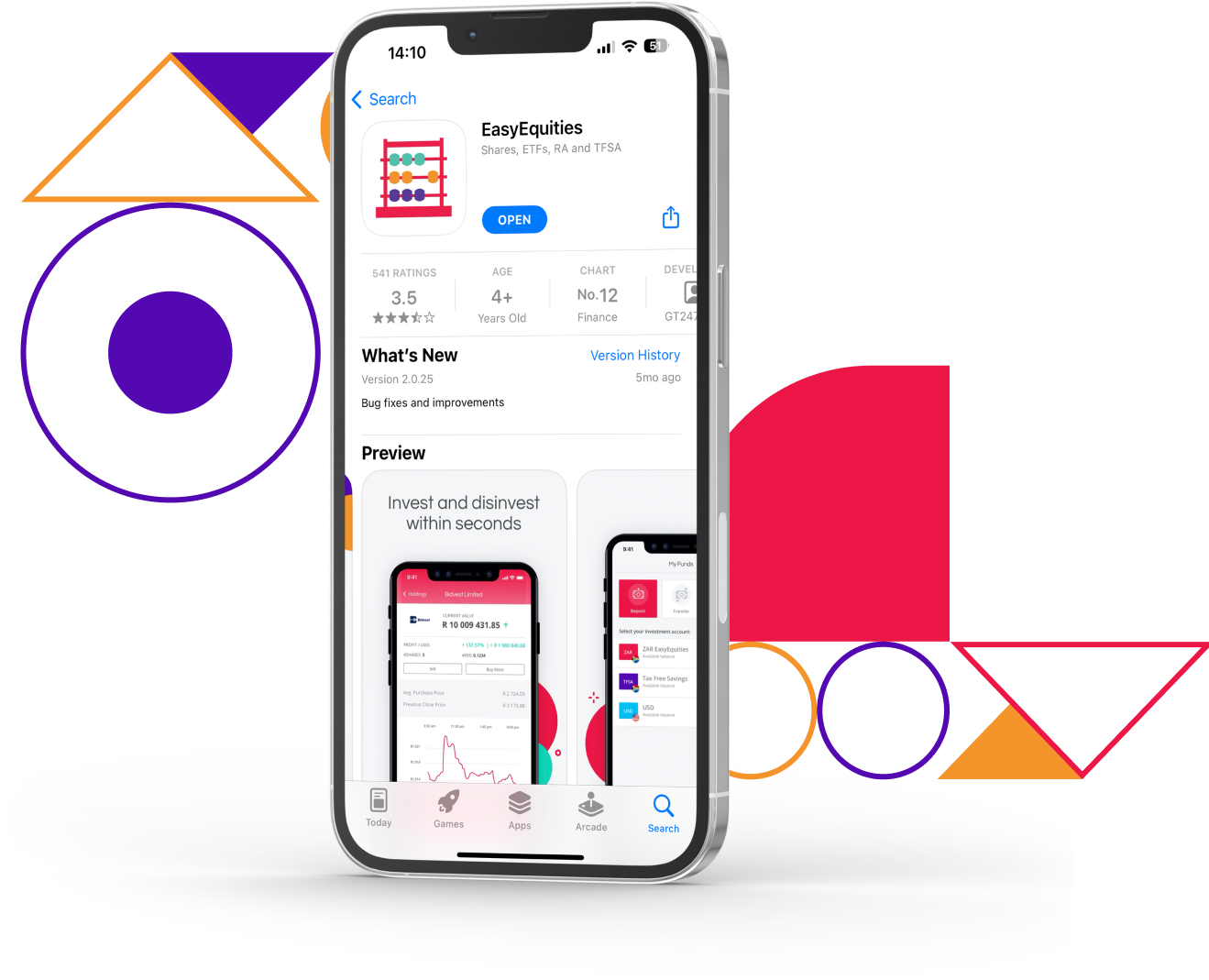

We're the affordable and diversified solution for smart investing, backed by Purple Group Limited, the pioneers behind EasyEquities. Our goal is to provide a safe, regulated, and easy-to-understand ETF experience, empowering investors with low-cost options for a secure financial future.

Regulated

Low Fees

Easy to Understand

No Minimums

Unlock the Advantages of Active ETF Investing

Explore the world of Active ETFs with EasyETFs, where you gain access to a range of benefits tailored for the modern investor. From transparency to tax efficiency, our Active ETFs are designed to align with your investment strategy and financial goals. Discover how our Active ETFs can make a difference in your portfolio.

Full Transparency

Experience complete visibility with EasyETFs. Our Active ETFs fully disclose holdings to empower your investment decisions.

Immediate Liquidity

Trade with ease. EasyETFs Active ETFs offer the flexibility to buy and sell on the stock exchange, anytime during trading hours.

Market Responsive

Stay agile with investments that adapt to market changes, offering flexibility and diverse opportunities.

Professional Expertise

Potentially benefit from the insights and expertise of experienced fund managers who adjust the portfolio in response to market conditions.

Cost-Effective Choices

Enjoy lower expense ratios with EasyETFs Active ETFs, optimizing your investment without sacrificing quality.

Understanding the Risks of Active ETF Investing

Every investment carries its own set of risks, and Active ETFs are no exception. We believe in transparency, so here’s a breakdown of the potential risks associated with investing in EasyETFs Active ETFs. It’s important for you to understand these risks to make informed investment decisions.

Market Fluctuations

Investing across diverse geographies and sectors, EasyETFs Active ETFs are subject to market volatility. Our investment manager, EasyAssetManagement, closely monitors these fluctuations to mitigate impact on performance.

Higher Expense Ratios

Active management involves higher expenses than passive ETFs. While striving for superior market performance, it's crucial to consider these costs and their potential effect on returns.

Dependence on Active Management

The success of our Active ETFs hinges on our fund manager’s skill in outperforming the market, a factor that adds an element of uncertainty compared to passive index tracking.

Manager Expertise

Performance is significantly influenced by our investment manager’s expertise. Regular due diligence reviews ensure alignment with our investment philosophy and strategy.

Past Performance Limitations

Historical performance of EasyETFs Active ETFs is not a guarantee of future results, highlighting the need for a cautious approach in projecting future returns.

Actively Managed ETFs (AMETFs) Explained:

Your Questions Answered

While ETFs typically track market indices passively, AMETFs offer active management, aiming to outperform the market with strategic investment choices. Dive into these distinct investment approaches to find the right fit for your portfolio goals.

-

What is an ETF?

An ETF gives you access to a collection of assets – like shares or bonds – all bundled into one fund. Think of it as a basket holding a variety of investments. Unlike regular funds, ETFs trade on the stock exchange, meaning you can buy or sell them throughout the day, just like a share. They’re known for being affordable, transparent, and easy to manage, making them a great way to diversify your investments. -

What Exactly is an AMETF?

An AMETF is a dynamic investment fund traded on stock exchanges, much like stocks. It's managed by professionals aiming to beat the market, offering you the expertise to potentially enhance returns. -

What Types of Assets Do AMETFs Invest In?

AMETFs aren't limited to one type of asset. They can include a mix of shares, bonds, commodities, and more, giving your portfolio broad exposure. -

What Are the Investment Goals of AMETFs?

Whether it's growing your capital, generating income, or minimising risk, AMETFs actively pursue specific objectives, adapting to market changes and economic trends. -

How Do AMETFs Differ from Passive ETFs?

Unlike passive ETFs that track an index, AMETFs leverage the insight of investment managers to make timely decisions that aim to surpass standard market indexes. -

How do AMETFs Differ From Unit Trusts?

AMETFs and Unit Trusts are both types of collective investment schemes, providing investors with a proportionate share of the underlying assets. However, they differ in structure, transparency, and trading. While Unit Trusts issue participatory units and are traded at the fund’s net asset value (NAV) once a day, AMETFs participatory interest are offered by the fund and listed, they trade as shares throughout the day on the stock exchange, offering greater liquidity. Investors can access ETFs directly via stockbrokers or platforms like EasyEquities, but should consider that ETFs, including AMETFs, may involve additional listing-related expenses. Both investments aim to grow wealth over the medium to long term, but AMETFs blend active management with the flexibility of stock exchange trading, setting them apart from traditional Unit Trusts. -

What Are the Risks and Rewards of Investing in AMETFs?

With the possibility of higher returns, AMETFs also bear the risk of underperformance, requiring a skilled manager at the helm. -

Are AMETFs Cost-Effective Compared to Passive ETFs?

AMETFs typically have higher fees than passive ETFs, but they offer the advantage of professional management and the potential for better returns.

Your Step by Step Guide to owning your first ETF

We explain step by step on how to get started. Simplify complex language the Easy way, from account setup to investing in your very first ETF.

EasyETFs

EasyETFs (RF) (Pty) Ltd (“EasyETFs”) (previously known as the Cloud Atlas (RF) (Pty) Ltd), the registered collective investment scheme manager of the EasyETF scheme (previously known as the Cloud Atlas scheme), which is a collective investment scheme approved by the Financial Sector Conduct Authority (“Scheme”). The Scheme is an authorised issuer of exchange traded funds on the Johannesburg Stock Exchange.